GOVERNMENT has set its sight on increasing insurance penetration from the current 2.5 percent to at least 5 percent by 2030, with stakeholders calling for stronger collaboration between insurers, regulators, innovators, and investors to close the protection gap that leaves millions of households vulnerable.

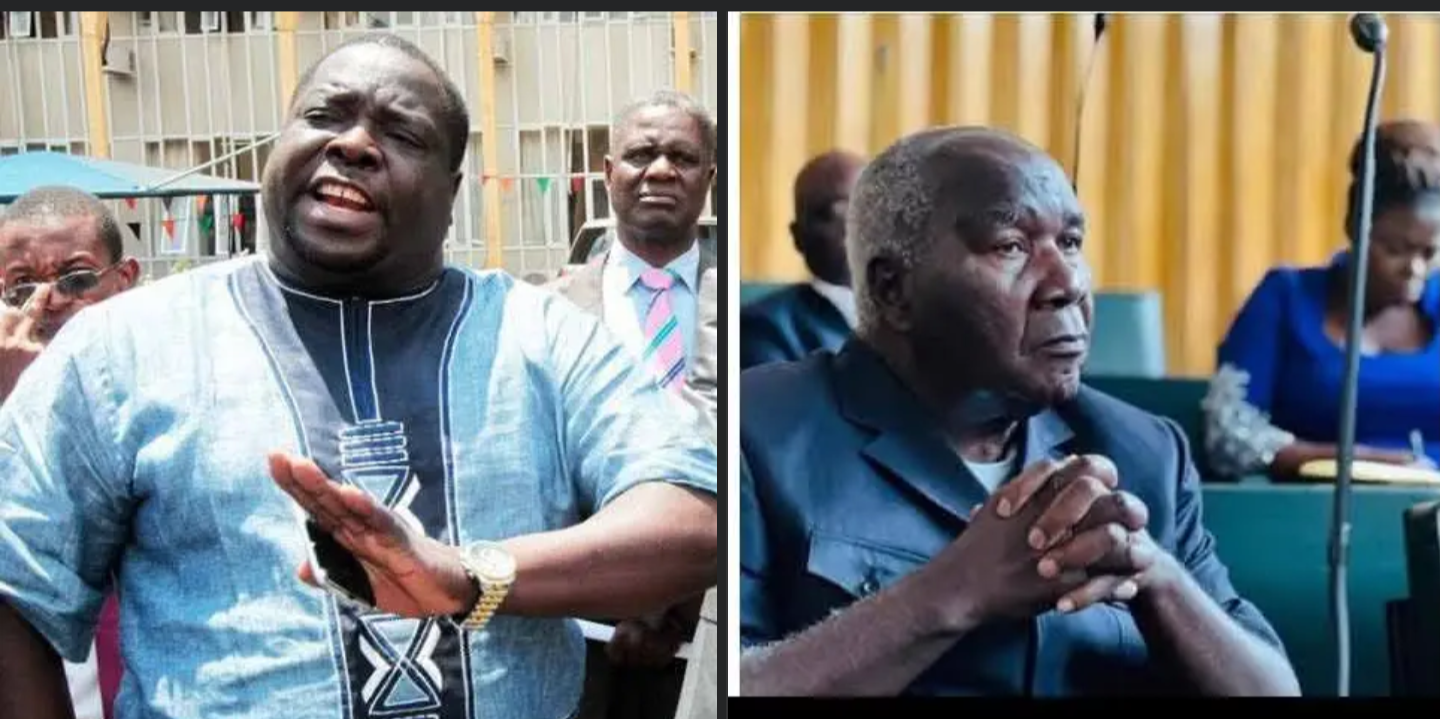

Acting minister of Technology and Science Elvis Nkandu said low uptake of insurance services continues to expose families, farmers, and small businesses to financial shocks from climate change, pandemics, and economic disruptions.

“This low uptake leaves many households, SMEs, and governments exposed to shocks. Closing this protection gap is not only a financial inclusion objective, but a national resilience agenda,” Nkandu said.

He urged insurers to adopt inclusive and flexible policies tailored to the realities of Zambians, while calling on innovators to seize opportunities offered to develop affordable, technology-driven products.

“Insurance companies should not view innovators as competitors, but as partners. This is the only way Africa will benefit from new ideas and resources,” added the minister.

Insurance penetration in Africa averages just three percent of GDP, less than half of the global average of seven percent, according to FSD Zambia CEO Lillian Chilongo Kangwa.

She warned that the gap leaves households vulnerable to climate disasters, health risks, and economic shocks, but noted that digital solutions present a game-changing opportunity.

“Digital technologies can reduce costs, expand access, and create room for innovation where services truly impact lives,” Kangwa said.

“The question is: are these products inclusive, affordable, and appropriate for underserved communities, including women and rural farmers?”

She highlighted FSD Zambia’s ongoing collaborations with the Pensions and Insurance Authority (PIA) to develop gender-inclusive regulation and regulatory sandboxes, alongside pilots offering insurance products to crop and livestock farmers.

PIA board chairperson Peter Banda said the regulator remains committed to financial inclusion, consumer protection, and innovation.

“Traditional insurance model is no longer sufficient to meet the unique pressing challenges of our continent….We must move beyond traditional metrics of gross return premium and measure success by reducing the protection gap,” he stressed.

Meanwhile, FSD Africa revealed that since its inception in 2020, BimaLab has supported over 100 startups across 25 African countries helped design 150 insurance products mobilised US$30 million in financing, and reached 60 million underserved customers.

Furthermore Nkandu stated that Zambia is aligning its digital insurance ambitions with the ICT Policy, the National Artificial Intelligence Strategy, and the Data Protection Act of 2021 while working with ZICTA and the Bank of Zambia to prepare infrastructure and regulatory frameworks for innovations.

“With innovation, collaboration, and resilience, Zambia can transform its insurance sector from exclusion to inclusion, and from fragility to strength,” said Nkandu.

The conference, themed Theme: “Building Bridges: Transforming Traditional Insurance by Accelerating Innovation” brought together regulators, policymakers, insurers, and technology innovators from 30 African countries.

Kalemba October 5, 2025